The Start Network and GlobalAgRisk will work together to develop a prototype for a Parametric Insurance product with funding from the Humanitarian Innovation Fund. The intention is to design a drought insurance product which will enable automatic pay-outs for early response to major food crises by civil society actors.

Despite widespread advances in early warning systems for major droughts, NGOs often struggle to put in place preventative measures because of their restrictive funding model. This funding model is dependent on media headlines generating public interest before major donors are mobilised to support a response. At this stage many lives have already been lost, livelihoods destroyed and hard-won development gains undermined. Early, preventative action in such situations has been found to be far more effective.

Parametric insurance is similar to normal insurance, in that in return for a yearly premium (calculated by expected frequency and severity of an event) a pay-out is received if the event takes place. However a key difference is that instead of making payments on the basis of losses measured after an event, it makes the payments automatically based on pre-agreed triggers. This means that there is no arguing about the amount of damage, and that the pay-outs are predictable. Better still, the triggers can be predictive, so you can receive pay-outs before an event actually occurs, in what is known as an ex-ante payment.

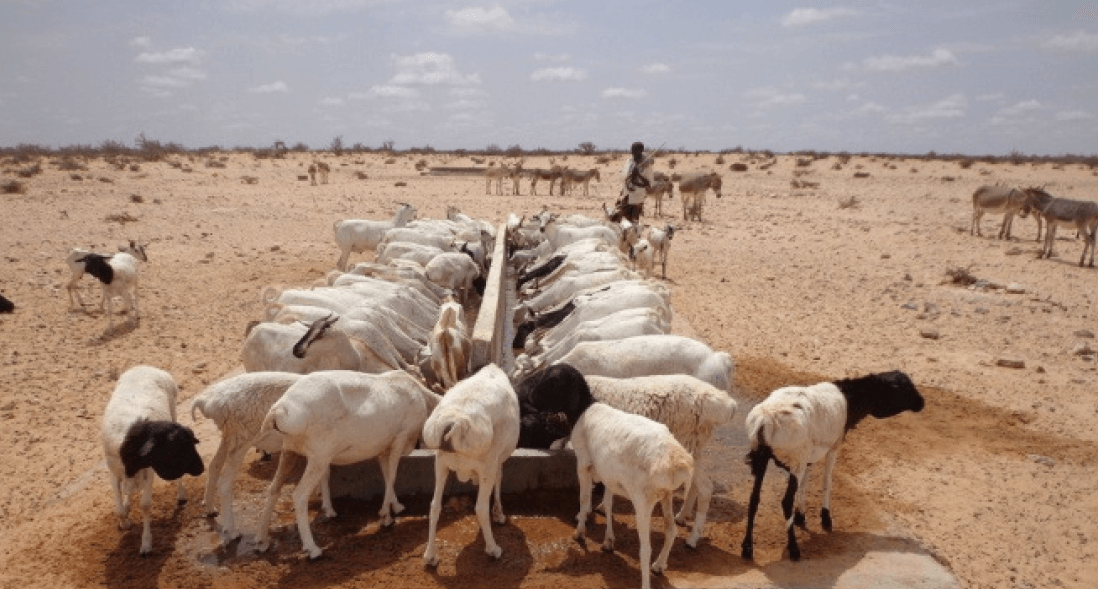

We will be exploring how to apply this mechanism to address some of the problems that prevent NGOs from responding effectively to slow onset food crises. Instead of waiting until images of famine reach TV screens or newspapers, a parametric insurance product could release funding much earlier. It would do this on the basis of a predicted food crisis, according to pre-agreed triggers. These triggers would be modelled and monitored by a neutral third party organisation. When a pay-out is made, these would then be allocated to NGOs and their civil society partners to mount early and preventative action.

With a small grant facility from the HIF, the Start Network and GlobalAgRisk will develop a prototype model to demonstrate the working principles of the parametric insurance mechanism. They will also outline a protocol for how the pay-outs would be allocated, and how the product will be implemented, and identify a selection of the drought-prone countries to be included in the risk transfer portfolio.

GlobalAgRisk is a research and development firm with a proven track record in developing and implementing innovative financial disaster risk management (FDRM) solutions that aim to build resilience to catastrophic natural disaster events such as drought, floods, and earthquakes.

This project is supported by the Humanitarian Innovation Fund, a programme managed by ELRHA (Enhancing Learning and Research for Humanitarian Assistance). The Humanitarian Innovation Fund (HIF) is a non-profit grant making facility supporting organisations and individuals to identify, nurture and share innovative and scalable solutions to the challenges facing effective humanitarian assistance. Visit www.humanitarianinnovation.org for more information.