In the past, the humanitarian system has been reactive and therefore very slow to act. This has meant that funding did not always reach the people who needed it at the right time.

Through our family of funds, we can ensure timely and reliable funding for crises - reducing their impact.

Why we need early and rapid financing

The needs of people affected by crises have changed. Factors such as climate change, inequality, conflict and increased urban densities mean that disasters are increasingly complex. They are also more frequent.

There has also been positive change: we have improved our ability to predict the likelihood and severity of hazards, and we have made progress in our understanding how vulnerability increases disaster risk. Despite all of this, the humanitarian system continues to react as though disasters are unexpected surprises, responding only after they happen and then often slowly.

A new approach is needed so that NGOs can act early when they see crises coming.

Our approach

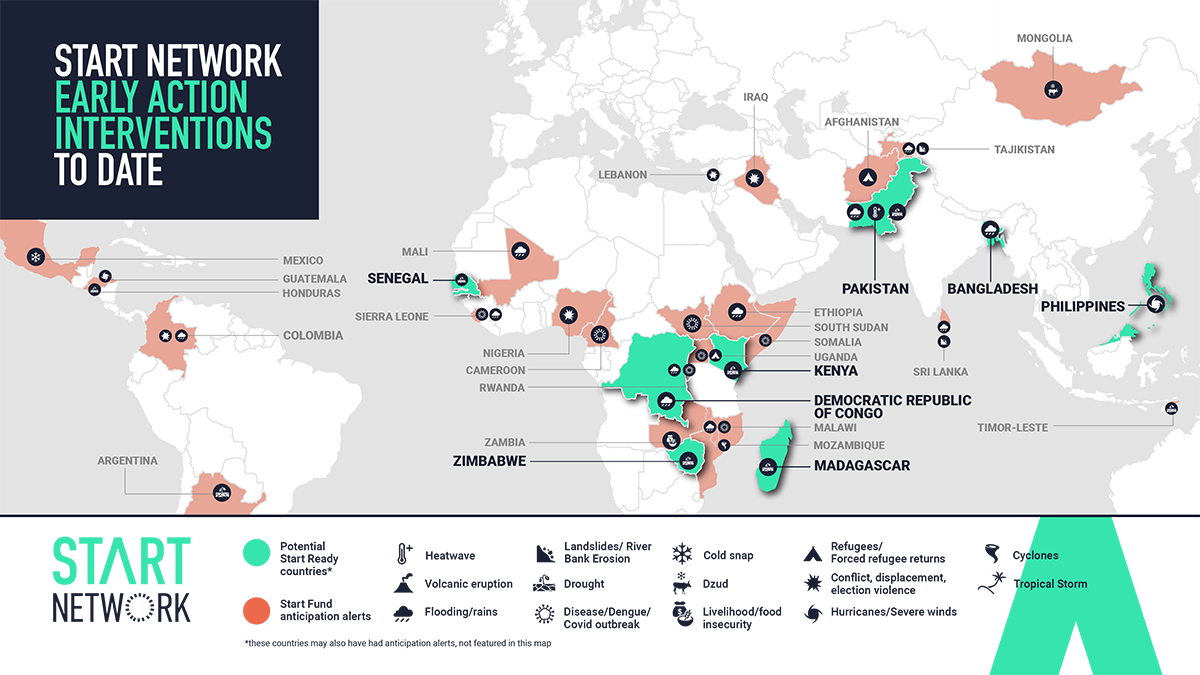

Start Network has created new funding instruments – different types of funding for different types of hazards. We have developed these thanks to pilot programmes such as Disaster Risk Financing Pakistan and ARC Replica in Senegal, which help us to learn what works best and what we still need to learn.

The early and rapid financing work is scaling, with local members developing their know-how and taking over management of anticipatory financing systems. We have developed several training resources to help make this happen.

Our programmes and funds

Anticipatory funding

Our global Start Fund provides funding for small to medium-scale crises and is based on dynamic, timely decision-making. Alerts are raised as soon as there are signs that a crisis is coming, decisions are made quickly and projects can be carried out in a short time period.

As well as responding to existing crises, Start Fund can also provide funding for anticipatory action, through anticipation alerts raised by our members when signs of a disaster are imminent.